florida death inheritance tax

This means if your mom leaves you 400000 you get 400000 there are no taxes to pay. 2 Inheriting at death is good because of stepped up basis.

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida does not have a separate inheritance death tax.

. The bad news is that the United States federal government does have an estate tax. 21 the estate tax rate was adjusted so that the first dollars are taxed at a 9 rate which ultimately maxes out at 16. Its against the Florida constitution to assess taxes on inheritance no matter how much its worth.

Florida is generous to the beneficiaries of wills and trusts because there is no tax on the money you inherit. Federal estate taxes are only applicable if the total estates value exceeds 117 million as of 2021. From Fisher Investments 40 years managing money and helping thousands of families.

Mom buys the house in 1980 for 10000. Nonetheless Florida residents may still have to pay inheritance tax when they inherit property from someone else. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax.

Previously federal law allowed a credit for state death taxes on the federal estate tax return. Most assets devised through a will inheritance process will not result in tax liability. This is only required if there was a taxable gift over 1206.

An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. If the married.

If someone dies in Florida Florida will not levy a tax on their estate. If the decedent was unmarried at the time of death and left no will but had one or more surviving descendants those descendants receive the entire estate. If someone dies and leaves behind a spouse who they were legally married to at the time of death the spouse is first in line to inherit everything.

Federal Estate Tax. The final individual state and federal income tax return must be filed by April 15 following the decedents death. If youre concerned about passing your property to your heirs because of taxes dont be concerned.

The rules for self proved wills are found in Florida Statute 732503. You sell the house after she dies. For Florida residents and Florida citizens the good news is that the does not have a Florida inheritance tax or an estate tax.

Florida doesnt have an inheritance or death tax. Spouses in Florida Inheritance Law. If you need to create a will or submit a will to probate call Florida Probate Law Group at 352 354-2654.

Federal Estate Taxes. If all the decedents children survive the estate is. However numerous laws determine who the rightful beneficiary is after a persons death.

Probate aets children inheritance florida proce munns surviving death rights. Florida doesnt collect inheritance tax. Florida Inheritance Laws can be complicated under certain circumstances.

Mom dies in 2012 when the house was worth 100000 and you inherit the house. Tax is tied to the federal state death tax credit to the extent that the available federal state death tax credit exceeds the state inheritance tax. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005.

If inheritance tax is paid within three months of the decedents death a 5 percent discount is allowed. There is no federal inheritance tax but there is a federal estate tax. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

To the extent its assets exceed the 1118 million exemption as of 2018 an estate is taxed at a marginal rate of up to 40. Sometimes referred to as the death tax or inheritance tax what is the inheritance tax or estate tax. In 2012 Mom deeds the house worth 110000 BEFORE she dies.

If someone dies in Florida Florida will not levy a tax on their estate. This law came into effect on Jan 1 2005. Estate tax is a tax levied on the estate of a person who owned property upon his or her death.

In Florida there are no estate or inheritance taxes. The federal government however imposes an estate tax that applies to residents of all states. The tax that is incurred is paid out by the trustestate and not the beneficiaries.

You have to pay taxes on the 100000 gain. Inheritance Law for Unmarried Decedents. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax.

However it is important to be aware that while there is no inheritance or estate tax the executor will still have to do the following. If there were no children either from the couple or from the deceaseds previous relationship then the surviving spouse is the sole heir. If someone dies in Florida Florida will not levy a tax on their estate.

A Florida Estate Gift Tax Attorney Can Help You. A federal estate tax return is usually due 9 months after the decedents death. The federal government then changed the credit to a deduction for state estate taxes.

This means if your mom leaves you. If you have questions about federal estate or gift taxes our Tampa estate planning attorneys at the Nici Law Firm can sit down with you to try and make sure they are. Our Gainesville FL probate lawyers work in every Florida Jurisdiction.

Florida Statute sections 732102 and 732103 specifically determine how a decedents property is divided when they die without a will under the 2022 Florida Probate Rules. You sell the house after she dies. However the federal government imposes estate taxes that apply to all residents.

The Federal government imposes an estate tax which begins at a whopping 40this would wipe out. The federal estate tax only applies if the value of the estate exceeds 114 million 2019 and the tax thats incurred is paid out of the estatetrust rather than by the beneficiaries. There isnt a limit on the amount you can receive either any money you receive as an inheritance is tax-free at the state level.

For multiple descendants Florida law divides the probate assets along generational lines. An inheritance tax is a tax levied against the property someone receives as an inheritance. Tax law is complex at the best of times but because of its unified nature estate and gift tax questions can be even worse.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Death Tax Is A Killer The Heritage Foundation

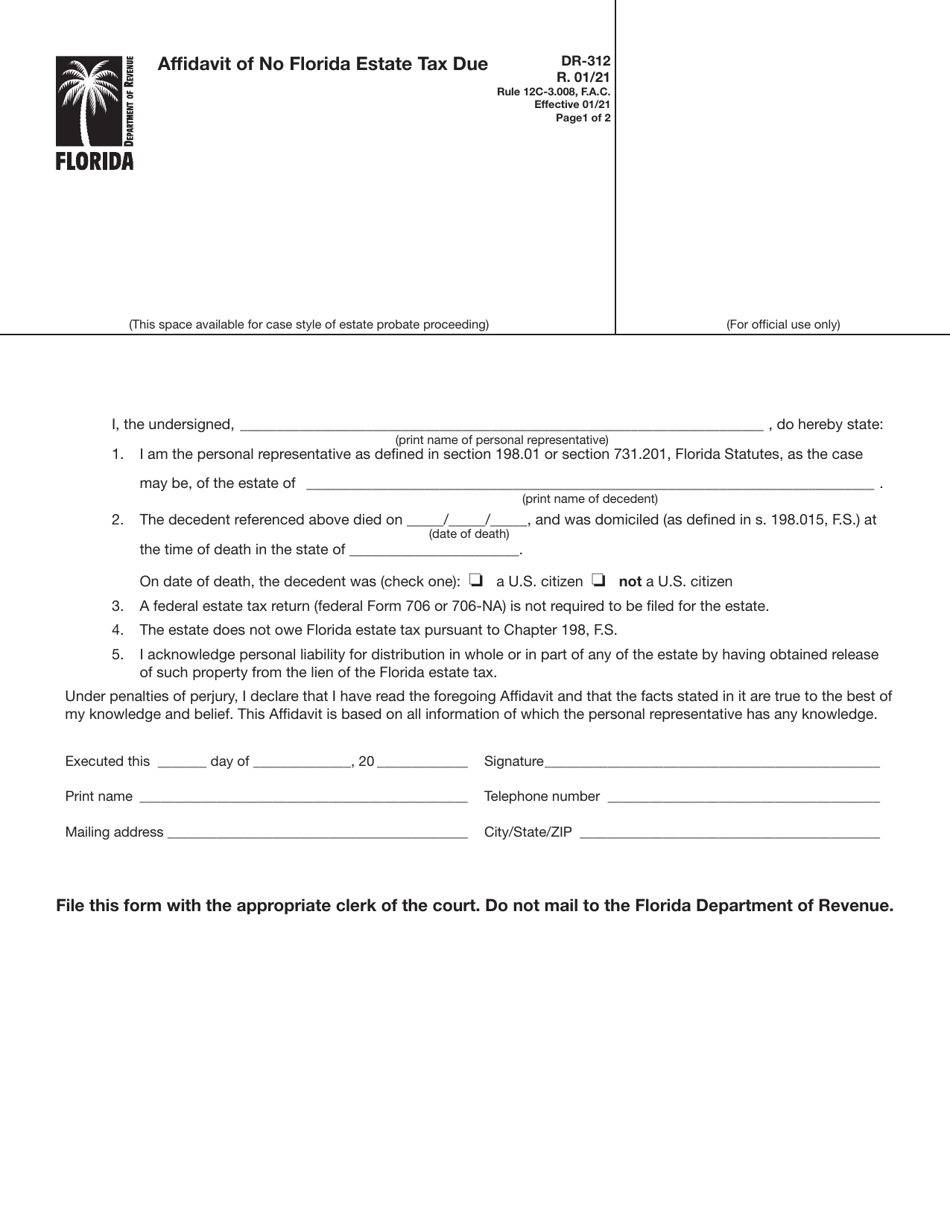

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

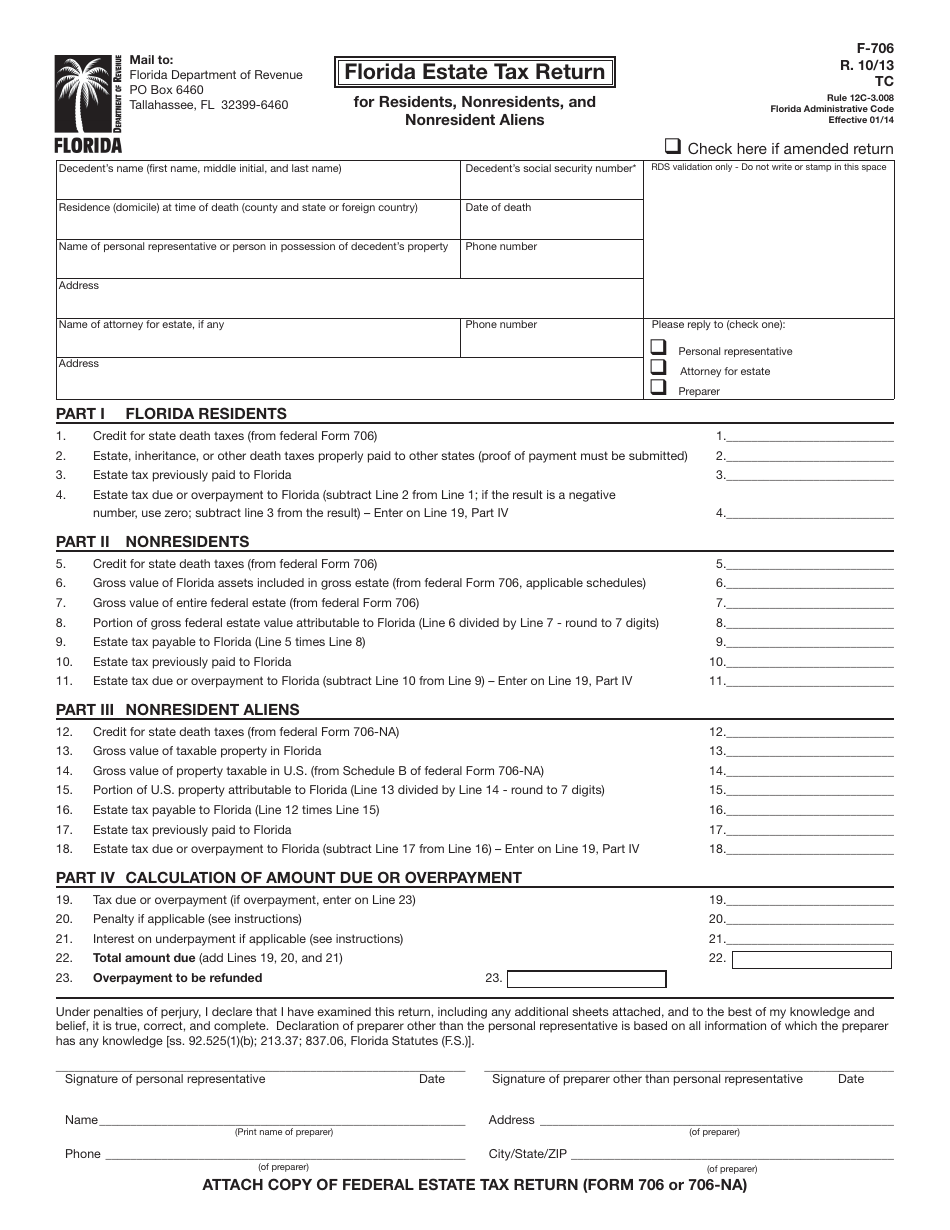

Form F 706 Download Printable Pdf Or Fill Online Florida Estate Tax Return For Residents Nonresidents And Nonresident Aliens Florida Templateroller

Does Florida Have An Inheritance Tax Alper Law

Does Florida Have An Inheritance Tax Alper Law

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Death And Taxes Nebraska S Inheritance Tax

Eight Things You Need To Know About The Death Tax Before You Die

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Florida Estate Tax Rules On Estate Inheritance Taxes

Florida Attorney For Federal Estate Taxes Karp Law Firm

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Florida Have An Inheritance Tax Alper Law

Legal Advice To Avoid Taxes On Inheritance Super Lawyers Florida